Simplify IFTA fuel tax reporting with our IFTA software by collecting and consolidating your fuel and state mileage data into a single, exportable report. Our fleet management solutions allow for effortless IFTA report generation.

The International Fuel Tax Agreement (IFTA) is an agreement between the 48 mainland states in the U.S. and 10 Canadian provinces for fuel tax collection and redistribution. Commercial motor vehicles that travel throughout multiple states and provinces within the member jurisdictions only have to maintain one fuel use license and file a single IFTA tax report.

Streamline IFTA reporting with our State Mileage reports and Fuel Log tool. No more collecting receipts, logging state mileage for every vehicle, or manual entry to create IFTA reports.

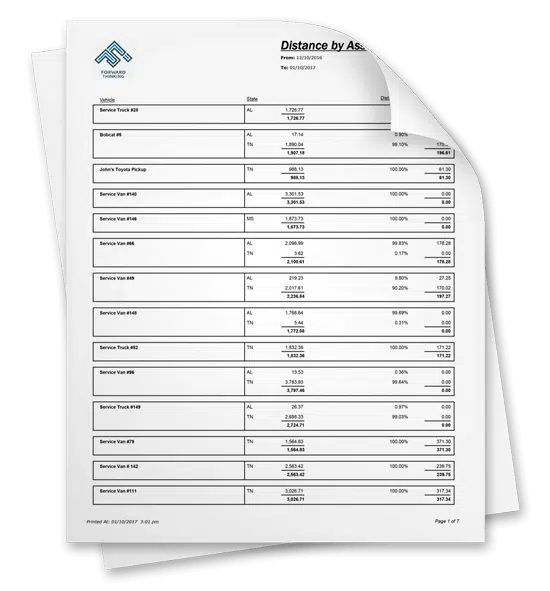

Our State Distance by Asset report automatically breaks down distance traveled by state so you don't have to. The IFTA report also includes fuel purchase data if you utilize our fuel card integration or Fuel Purchase Log to track fuel receipts.

The Fuel Purchase Log is available if you want to input individual fuel receipts. We recommend this feature if you don't utilize fuel cards or want to keep your fuel data separate from our software. Similar to how the fuel card integration works, the Fuel Purchase Log data is also conveniently displayed on the State Distance by Asset IFTA report.

Stay compliant and keep all of your fuel and location data together without the hassle of manually creating IFTA reports. Our system integrates with any fuel card provider, including Wex, Wright Express, and Comdata.

Fuel card integrations are the ideal solution for quick and simple IFTA reporting. Automatically import data from your fuel card provider like location, gallons, total cost, and date/time of the fuel purchase.

Not with one of the “big guys?” No problem. By utilizing our FTP uploads and web services, our solution will integrate with any fuel card, ensuring that your IFTA tax data is centralized regardless of your fuel card provider.

To stay on top of IFTA reporting, the ideal situation is to use an IFTA reporting software in tandem with an ELD and fuel card integration. If you plan to manually track and log your IFTA records, you will need to keep a detailed log book of trip details including every fuel purchase, total miles driven, odometer readings, total gallons purchased, and miles traveled by state for your entire fleet. You'll need all of this data along with state fuel tax rates to calculate and file reports for your fleet.

First, gather all data for fuel purchases (purchase location, gallons purchased, state fuel taxes) and mileage by state. For calculating your IFTA taxes owed, it's recommended that you use an online IFTA calculator or IFTA software.

To calculate:

Total Miles Driven (All States) ÷ Total Gallons Purchased (All States) = Total Fuel MileageTotal Miles Driven (in State "X") ÷ Total Fuel Mileage = Gallons Burned (in State "X")Total Gallons Burned (in State "X") x Fuel Tax Rate (for State "X") = Fuel Tax Required (for State "X")Total Gallons Burned (in State "X") x Surcharge Rate (for State "X") = Surcharge Required (for State "X")Total Gallons Purchased (in State "X") x Fuel Tax Rate (in State "X") = Fuel Tax Paid (in State "X")Fuel Tax Required (in State "X") – Fuel Tax Paid (in State "X") = Fuel Tax Owed (in State "X")Fleet managers should have their IFTA return submitted to their base jurisdiction in either a yearly or quarterly report. Upcoming reporting periods for quarterly IFTA returns are as follows:

Reporting Period: July 1 - September 30

Due Date: Oct 31,

2022

Reporting Period: October 1 - December 31

Due Date: Jan 31,

2023

Reporting Period: January 1 - March 31

Due Date: May 1,

2023

Reporting Period: April 1 - June 30

Due Date: July 31, 2023

Reporting Period: July 1 - September 30

Due Date: Oct 31,

2023

Reporting Period: October 1 - December 31

Due Date: Jan 31,

2024

Ready to make fleet management more manageable?

Schedule your demo today!