Is your business in need of a fleet fuel card? Would you like to know which one is best? Or how they work? Are you interested in saving 65% off tires or 20% off maintenance on top of savings at the pump? How about 49¢ saved per gallon?

In this article, we’ll cover what fuel cards are, how they work, who should use them, their benefits, and how to choose the best one for your business in 2023.

Let’s dive in.

Updated: 7/12/2023

A fuel card, or fleet card, is a type of credit card that can be used to purchase gas and diesel for fleet vehicles. It’s different from a traditional credit card in that it’s specifically for vehicle expenses like fuel.

Typically, fuel cards are administered by large fuel companies and can be used at a range of different fuel stations.

The main advantages of using a fleet card are convenience and cost savings. Since fuel cards offer discounted fuel prices, they can help businesses to save money on fuel costs over time.

In addition, using fuel cards can be more convenient than purchasing fuel in cash since it generally takes less time and effort to swipe a fuel card than it does to withdraw and carry around cash.

Overall, if you are looking for an easy way to purchase fuel while keeping your business costs low, managing spending limits, and getting some bonus perks, a fleet fuel card is the ideal solution!

Imagine you’re a long-haul trucker driving cross-country with a load of fragile cargo. You’re running low on fuel and funds, and your truck really needs cleaning too. Unfortunately, fuel prices in the area are higher than you expected and only getting worse.

If only you could fill up without having to spend your wash budget on fuel… This is where fuel cards come in handy!

Fuel cards are essentially credit cards that can be used to purchase fuel at participating gas stations for a discount.

For truckers, fuel cards can be a lifesaver, allowing them to fuel up at a bargain and get extra perks like discounted washes.

But how do fuel cards work?

Fuel cards are issued by fuel companies and can be used at any gas station that accepts that particular brand of fuel card. But be aware, they often come with setup, annual, or monthly fees.

In order to use a fuel card, simply swipe it at the pump, and the amount purchased will be deducted from your account balance.

If you’re using a prepaid card, when your account balance runs low, simply add funds online or by phone. It’s that easy!

So if you manage a fleet or regularly drive cross-country for work, don’t hesitate to implement a fuel card – it’ll make life a lot easier.

A fleet card program is reserved for businesses. Businesses of all sizes and industries can get a fuel card as long as they meet certain eligibility requirements.

These requirements typically include having fuel-using vehicles in the business’s fleet and having adequate creditworthiness to qualify for the card.

Additionally, many fuel card providers require that businesses submit an application and provide proof of insurance before they will issue a fuel card.

Overall, businesses that need fuel regularly should strongly consider integrating a fuel card to streamline their fuel purchasing process and save time and money.

If you manage a fleet of vehicles, you know how important it is to keep track of employee spending.

Fuel is one of the largest expenses for any business that relies on transportation. As such, it’s crucial to manage this expense carefully. Fleet fuel cards can help you do just that while limiting the temptation to use a credit card on unauthorized purchases.

With a fuel card, you can set spending limits and track employee usage. You can also enjoy discounts of up to 20 cents per gallon! This makes a huge difference as fuel prices continue to rise. Over time, that adds up to significant savings.

In addition, many fleet fuel cards help you save on both fuel and maintenance costs, so you can keep your vehicles in good condition and reduce fuel spending at the same time.

Here are some of the most common fuel card benefits:

Whether you’re looking to manage employee spending or get discounts on fuel and vehicle maintenance, fleet fuel cards can be a valuable tool for any business.

If you’ve ever wondered how to choose a fleet fuel card, you’re not alone.

With so many options on the market, it can be tough to know which one is right for your business.

Here are six areas to consider when making your decision.

Many fleet fuel cards offer discounts at filling stations. Most cards offer discounts of a few cents per gallon, but some offer as much as 45 cents per gallon off. Higher discounts typically come with a smaller network though, so look closely at each card’s details.

Lastly, some cards even offer additional discounts on in-store purchases and maintenance services.

By using a fleet card, fleet managers can significantly reduce their costs and make their operations more efficient. So, if you’re a fleet manager, be sure to carefully research discounts when selecting a fuel card for your business. You may be surprised at how much you can save.

Card acceptance is perhaps the most important consideration when it comes to selecting a card. Fleet managers should heavily weigh card acceptance and coverage at fueling and service stations.

Some fleet cards only receive fueling discounts at specific stations. So, it’s important to make sure your chosen card will work with the stations you frequent most, or that are available near your most frequent fleet routes.

Additionally, most fleet fuel cards are also accepted at service locations for maintenance, so you can keep all your vehicle-related expenses on one card.

Whether it’s a universal card or one with a small network, just make sure it works for you and is accepted at the gas and service stations you’ll use. Otherwise, you’ll miss out on the discounts and benefits that come with the card.

When choosing a fuel card program, fleet managers should also consider additional fuel card benefits like cashback, loyalty, or rewards points.

Some fuel cards offer these additional benefits, which can save the business money or provide other perks. For example, a fuel card with loyalty rewards could allow the fleet to get discounts at certain gas stations or restaurants. Or, a fuel card with rewards points could allow the manager to redeem points for free items or gift cards.

All of these fuel card benefits can be helpful to fleet managers in saving money or providing better work benefits for their drivers.

When it comes to fuel cards, fleet managers have a lot to consider. One of the most important factors is fuel usage reporting. After all, fuel is one of the biggest expenses for any fleet. Without adequate reporting, it can be difficult to track fuel spending and identify areas where costs can be reduced.

Fortunately, most fuel cards offer comprehensive fuel usage reporting that can help fleet managers save time and set adequate spending controls.

In addition, many fleet fuel cards are fully integrated with IFTA reporting as well, so fuel taxes can be easily tracked and paid.

While there are many areas to consider, fuel usage and IFTA reporting should be high on the list of priorities for any fleet manager looking for a new fuel card.

The size of your fleet will also affect your choice of fuel card. Some cards have minimum spending requirements or only work with certain fleet sizes. Be sure to check the requirements of each card before making your decision.

As a fleet manager, choosing the right fuel card is an important decision. Not only do fuel cards help to simplify fuel payments and track fuel usage, but they can also save you money on fuel expenses and eliminate associated administrative expenses.

However, one thing that many fuel card companies don’t advertise is that some of their cards are not suitable for smaller fleets. Some cards have minimum spending requirements or only work well with larger fleet sizes, so it’s important to check the requirements of each card before making your decision.

If you have a small or medium-sized fleet, it’s crucial to find a fuel card that works well for your specific needs. For example, some cards may require a minimum monthly spend or annual revenue that may not be feasible for smaller fleets. Additionally, the choice of service stations can be crucial if you need access to specialized services at particular locations.

Overall, when it comes to choosing the right fuel card for your business, size matters! By taking the time to carefully consider your specific needs and requirements, you can ensure that you find the best fuel card for your fleet’s needs.

When choosing a fuel card, fleet managers should consider the security features of the various offerings on the market. Some cards utilize driver and fueling station location data, as well as require driver IDs and odometer readings before authorizing a transaction.

Others consider the geolocation of the driver, station, and Engine Control Unit (ECU) data as well before authorizing a transaction. This can be extremely helpful for stopping the misuse of lost or stolen cards.

Features like these can help to provide a more comprehensive picture of each driver’s usage patterns and behavior, allowing for better oversight and control over fuel expenses. Additionally, they help to keep drivers honest and accountable, discouraging any potential fraud or misuse of company funds.

Overall, when carefully considering all available options, fleet cards with robust security features can help fleet managers get the most out of their fleets and keep costs in check.

WEX is the premiere nationwide coverage option for businesses. They claim coverage at 95% of U.S. fueling stations or anywhere major credit/debit cards are accepted. Many other cards offer the same coverage and do so through the WEX network.

TCS offers a massive discount of 49 cents per gallon!

The primary tradeoff is its network size. Don’t expect to find the discounts everywhere as they only boast a network of 1,500+ participating stations. However, TCS combats this with a fuel-finder app to help drivers locate in-network fueling stations.

Other benefits include standard card management, IFTA reports, and Zelle payment compatibility in the TCS mobile app for secure transfers.

Choosing the best card for small fleets truly depends on the individual business’ most pressing needs. For fraud prevention, go with Comdata. Need a nationwide network? WEX FlexCard or Shell Small Business Fleet Card is your best bet. Need maximum fuel cost savings and are willing to sacrifice an extensive network? Sign up with TCS or RTS.

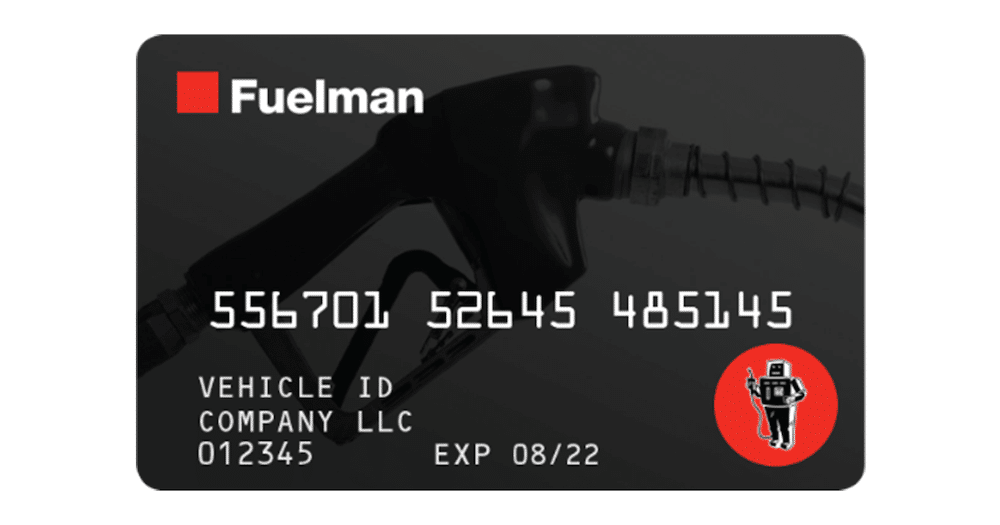

We like the Fuelman Diesel Fleet Card for large fleets. Fuelman delivers a network of 50,000+ stations. Furthermore, the Diesel Fleet Card offers rebates of 12 cents per gallon on diesel. Other important details include:

Comdata has some of the best security features available. In late 2020, they introduced real-time truck location, tank capacity, fuel level, and merchant location-based authorization features for its fleet cards. This makes card fraud and driver theft extremely difficult.

Other details worth noting:

WEX fleet cards are our pick for best overall, thanks to a network that includes 95% of all U.S. fueling stations, several card options, good reviews, and good fuel discounts for other services like hotel stays and vehicle maintenance, despite a low rebate of only 3 cents per gallon.

WEX has a wide array of fleet fuel cards that can be used at almost any fuel station in the United States. They also offer a mobile app and online account management so you can easily track your spending, set purchase controls, and more.

The only downside to WEX cards is that their fees are unpublished, and WEX cards carry a relatively low rebate of just 3 cents per gallon. But, overall, we think they’re the best option for most fleets.

Fleet fuel cards are an essential part of managing a business fleet. These handy cards are designed to help simplify your billing and manage your fuel expenses more effectively.

Here, we’ll give a breakdown of some of the most popular cards available. We’ve outlined the key features and benefits of each card, including things like fuel savings, maintenance discounts, easy reporting, and more.

By taking a closer look at these different options, you’ll be able to easily decide which card is right for your needs and budget.

WEX FlexCard is a great option for drivers or managers who are looking for a reliable, universal fuel card. The WEX FlexCard offers an average discount of 3 cents per gallon, and it can be used at 95% of all U.S. fuel stations and 45,000+ service locations. Additionally, the FlexCard offers other rewards and benefits such as discounted hotel stays and spending controls.

The WEX FlexCard is a great choice for fleets looking for a proven, reliable, and affordable fuel card.

Highlights

Find out where WEX is accepted here.

This WEX fleet card is a great option for businesses looking for coverage at truck stops. With an average fuel discount of 15 cents per gallon, it’s one of the most competitive cards on the market. And with a network of over 3,400 locations, you should be able to find a station that fits your needs. This card also offers 24/7 US-based support and spending controls.

So, if you’re looking for a card that can help you save big on fuel, the WEX Fleet Cross Roads Card is a great option.

Highlights

The Shell Fleet Plus Card is the perfect solution for businesses that need a reliable, fee-free fuel card. With an average fuel discount of 6 cents per gallon and access to over 13,000 Shell & Jiffy Lube locations across the country, it is a great choice for any company that needs to keep its vehicles running smoothly.

Whether you primarily drive long distances or prefer smaller city routes, the Shell Fleet Plus Card has you covered. So, if you are looking for a convenient and cost-effective way to power your business operations, be sure to check out the Shell Fleet Plus Card.

Highlights

The Fuelman Diesel Fleet Card is a powerful way to keep your fuel budget in check. With a discount of 12 cents per gallon and a network of over 50,000 fueling stations across the country, this card gives you the opportunity to save while also protecting against fuel purchase fraud and security risks up to $25k per year.

It does so with industry-leading geolocation and ECU data to authorize transactions.

So whether you’re running a small business or a large fleet, the Fuelman Diesel Fleet Card is a great choice for managing fuel costs efficiently and securely.

Highlights

The BP Business Solutions Mastercard is the ideal card for businesses with large fleets. With an average discount of 4.6 cents per gallon, this card offers significant savings at more than 7,200 BP and Amoco fueling stations across the country.

Additionally, its network is designed specifically to meet the needs of larger fleets. Whether you need flexibility in purchasing fuel, help managing your fuel tracking, or access to added benefits like IFTA tax reporting, the BP Business Solutions Mastercard has you covered.

Highlights

The ExxonMobil BusinessPro Card is a great way to save on fuel for your business. With a discount up to 6 cents per gallon, it can quickly add up to big savings. Plus, with access to over 95%of US gas stations, you’re sure to find a convenient location no matter where you’re traveling.

Best of all, the ExxonMobil BusinessPro Card is highly customizable, so you can tailor it to fit your business’s unique needs.

Whether you’re looking for great savings on fuel purchases or maximum flexibility, the ExxonMobil BusinessPro Card is a great choice.

Highlights

The Fleet One EDGE Card is a great option if you’re looking for significant discounts on fuel and tires. The average fuel discount is 15 cents per gallon, with a network of 3,000+ nationwide.

Perhaps the best thing about this card is that it helps significantly with large discounts on tire purchases (up to $40 per tire). So, if you’re constantly in the market for a new set of tires, the Fleet One EDGE Card is a top contender.

Highlights

The RTS Fuel Card is a great way to save money on fuel for your business. With an average discount of 25 cents per gallon, you can quickly see the savings add up.

The RTS Fuel Card’s weekly line of credit is very helpful for businesses that need to fuel multiple vehicles. With a network of only 2,400 fueling stations, it may be difficult to find a station near you, but they do offer an app to find stops more easily.

So, if you’re looking for a fuel card that offers big discounts and a convenient line of credit, the RTS Fuel Card is a perfect choice. Also, you gain free credit checks on over 85,000 brokers and shippers.

Highlights

Looking to save big on gas? The TCS Fuel Card is your best bet. With discounts averaging 49 cents per gallon, it is by far, the best way to stretch your dollar at the pump.

Unfortunately, TCS only carries a network of 1,500+ fueling stations. So, you may have trouble finding a participating station near you. Thankfully, they offer a fuel finder tool in their mobile app. But if you’re looking for the highest possible savings on gas, the TCS Fuel Card is the way to go.

Highlights

TCS fuel cost savings calculator.

Now that we’ve gone over all the important details, let’s summarize how you should choose one for your business.

Here are the six things to consider when choosing a fuel card for your fleet:

1.) Discounts: Most fuel cards offer discounts at certain gas stations, so it’s worth doing your research to see if there are any fuel cards that offer discounts at locations that you frequently visit.

2.) Network Size: Another thing to consider is the size of the fuel card network. Some fuel cards are only accepted at a limited number of gas stations, while others are accepted at thousands of locations nationwide.

3.) Benefits: Many fuel cards come with additional benefits, such as wash discounts or points that can be redeemed for merchandise or travel. Be sure to compare the benefits of different fuel cards to see which one offers the best value.

4.) Reporting: You’ll want to choose a fuel card that offers detailed reporting features so you can track your expenses and manage your budget more efficiently while also having your regulatory reports in order.

5.) Fleet Size: You’ll want to carefully look at your fleet size when choosing a card. Some cards require certain amounts of fuel to be purchased for their worthwhile discounts. These benefit larger fleets while other cards offer excellent flexibility for smaller ones.

6.) Security: Research the security and fraud prevention features of available fuel cards. Most cards require driver IDs and odometer numbers, but others go even further with geolocation and ECU data before authorizing a purchase.

Wrapping it up: Fuel cards are a great way for fleets to manage their expenses and save money. By using fuel cards, fleets can track their spending, earn rewards, get discounts on fuel purchases, and more.

Fuel cards are a convenient way to pay for gas, but do they require a credit check?

It depends. Many fleet cards are typically available without a credit check. However, these cards may have strict limits on how much can be spent per month based on your membership plan.

Other fleet cards will require a credit check. Many options exist that accommodate low-credit scores. Oftentimes, if your business does not qualify based on its credit score, you can still qualify with an additional deposit or fee.

So, if you’re looking for a fuel card with no credit check, you’ll want to do your research and weigh the benefits vs. the card fees.

The WEX FlexCard offers no setup, annual, or card fees and comes with a 3 cents per gallon rebate. This is a great option to get started right away as the FlexCard is accepted at 95% of stations nationwide.

That said, most fleet cards offer an extremely simple or zero-fee application process and are easy to qualify for in one way or another. If your business does not meet the credit requirements, you can most likely pay a simple deposit to get your account started.

This depends. Some fleet cards do not charge any regular fees. However, others require setup, annual, or monthly fees. These cards often come with greater savings and benefits as a trade-off.

Generally speaking, if you select the right fuel card for your business, you’ll save on overall expenses.

Yes. Fleet cards typically offer 3 cents per gallon or more rebates on diesel or gas purchases. Additionally, most fleet cards offer discounts on other purchases as well, such as maintenance, washes, and more.

Individuals can get a fuel card, but it won’t be the same as a fleet card. GasBuddy is an example of a popular fuel card that’s perfect for individuals. It includes an app and several plan options to help you save money when you’re off the clock and in your personal vehicle.

Nearly every gas station accepts fuel cards. However, not every fleet card can be used at every station.

For example, the Shell Small Business Card has a network of nearly 13,000 participating Shell and Jiffy Lube locations. In contrast, the Shell Fleet Navigator Card can be used at 95% of all U.S. fueling stations and 45,000+ service locations.

Universal fleet card options like the FlexCard from WEX and Shell Fleet Navigator Card typically claim coverage at 95% of stations or more.

The TCS fuel card consistently offers the biggest discount on fuel only, saving clients an average of 49 cents per gallon at in-network locations.

But our pick for the best overall discount goes to the EFS Fleet One EDGE Card offers excellent savings and rewards but comes with a slightly smaller network. The EDGE card delivers an average of 15 cents per gallon at 4,500 participating discount locations. EDGE is accepted at over 12,000 truck stops nationwide and offers an average discount of over $100 off MSRP per tire on tire purchases. Furthermore, fleets can save on wireless plans, repairs, hotels, and more with the EDGE card.

Cards offered by WEX, Shell, 7-Eleven, Exxon Mobile, Speedway, and more are accepted anywhere major credit/debit cards are accepted. These options typically claim coverage at over 95% of U.S. stations and are part of the WEX network.

Ultimately, if you need nationwide coverage, you have numerous options to choose from.

This largely depends on your specific line of work and region. But RTS offers one of the best cards for owner-operators.

RTS extends a generous weekly line of credit and discounts up to 25 cents per gallon. Their network size is small at 2,000+ stations, but they help by providing a locator in their app.

We hope that this article has been helpful in explaining the benefits of fuel cards and how to choose the best one for your fleet.

If you have any other tips or questions, drop a comment below!

Recent Posts

Categories

Stay in Touch

Ready to make fleet management more manageable?