Simplify IFTA fuel tax reporting with our IFTA software by collecting and consolidating your fuel and state mileage data into a single, exportable report. Our fleet management solutions allow for effortless IFTA report generation.

The International Fuel Tax Agreement (IFTA) is an agreement between the 48 mainland states in the U.S. and 10 Canadian provinces for fuel tax collection and redistribution. Commercial motor vehicles that travel throughout multiple states and provinces within the member jurisdictions only have to maintain one fuel use license and file a single IFTA tax report.

Streamline IFTA reporting with State Mileage reports and a Fuel Log tool. No more collecting receipts, logging state mileage for every vehicle, or manual entry to create IFTA reports.

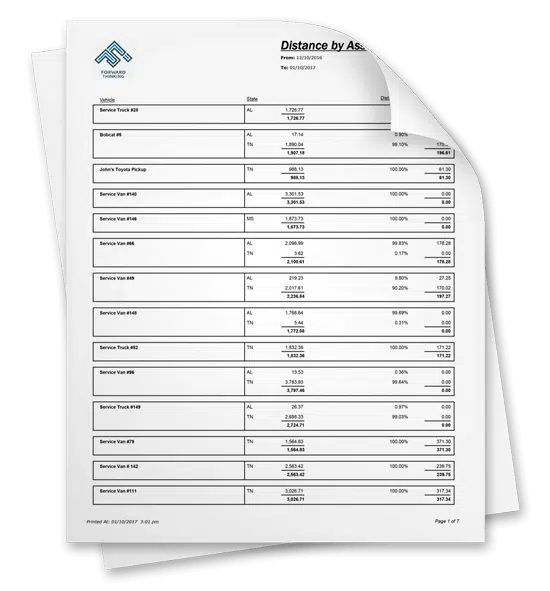

The State Distance by Asset report automatically breaks down distance traveled by state, eliminating manual recording and calculations. The IFTA report also includes fuel purchase data through a fuel card integration feature or through a Fuel Purchase Log, which tracks fuel receipts.

The Fuel Purchase Log is available to fleets that don’t use fuel cards or want to keep separate fuel data by manually adding individual fuel receipts. Similar to how the fuel card integration works, the Fuel Purchase Log data is also conveniently displayed on the State Distance by Asset IFTA report.

Stay compliant and keep all of your fuel and location data together without manually creating IFTA reports. Our IFTA reporting system integrates with any fuel card provider, including Wex, Wright Express, and Comdata.

Fuel card integrations are the ideal solution for quick and simple IFTA reporting. Automatically import data from your fuel card provider like location, gallons, total cost, and date/time of the fuel purchase.

Not with one of the “big guys?” No problem. By using FTP uploads and web services, our solution will integrate with any fuel card, ensuring that your IFTA tax data is centralized regardless of your fuel card provider.

To stay on top of IFTA reporting, the ideal situation is to use an IFTA reporting software in tandem with an ELD and fuel card integration. If you plan to manually track and log your IFTA records, you will need to keep a detailed log book of trip details including every fuel purchase, total miles driven, odometer readings, total gallons purchased, and miles traveled by state for your entire fleet. You'll need all of this data along with state fuel tax rates to calculate and file reports for your fleet.

First, gather all data for fuel purchases (purchase location, gallons purchased, state fuel taxes) and mileage by state. For calculating your IFTA taxes owed, it's recommended that you use an online IFTA calculator or IFTA software.

To calculate:

Total Miles Driven (All States) ÷ Total Gallons Purchased (All States) = Total Fuel MileageTotal Miles Driven (in State "X") ÷ Total Fuel Mileage = Gallons Burned (in State "X")Total Gallons Burned (in State "X") x Fuel Tax Rate (for State "X") = Fuel Tax Required (for State "X")Total Gallons Burned (in State "X") x Surcharge Rate (for State "X") = Surcharge Required (for State "X")Total Gallons Purchased (in State "X") x Fuel Tax Rate (in State "X") = Fuel Tax Paid (in State "X")Fuel Tax Required (in State "X") – Fuel Tax Paid (in State "X") = Fuel Tax Owed (in State "X")Fleet managers should have their IFTA return submitted to their base jurisdiction in either a yearly or quarterly report. Upcoming reporting periods for quarterly IFTA returns are as follows:

Reporting Period: First Quarter

Due Date: April 30, 2024

Reporting Period: Second Quarter

Due Date: July 31, 2024

Reporting Period: Third Quarter

Due Date: October 31, 2024

Reporting Period: Fourth Quarter

Due Date: January 31, 2025

Ready to make fleet management more manageable?